(How to predict market direction?)

Now that you know how to trade in Option, you are ready to take your first trade-in Option.

The most important question now is: When to enter a Trade?

All your trading journey revolves around searching for the best setup, and the best entry condition to make a profit from the market. So let me share with you some of the setups/entry conditions which will help you to start your Options trading journey.

Identifying Trends in a Chart

You all must have heard ‘Trend is your friend’, however, I would rephrase it with ‘Trend is your Gold Mine’. Trust me, if you master this art of identifying trends, and points where you can make an entry, you can make money consistently from the market. All the big & known traders make money from this simple technique which is “Identifying trend’. So let me take you through one “Trend Identifying Setup’.

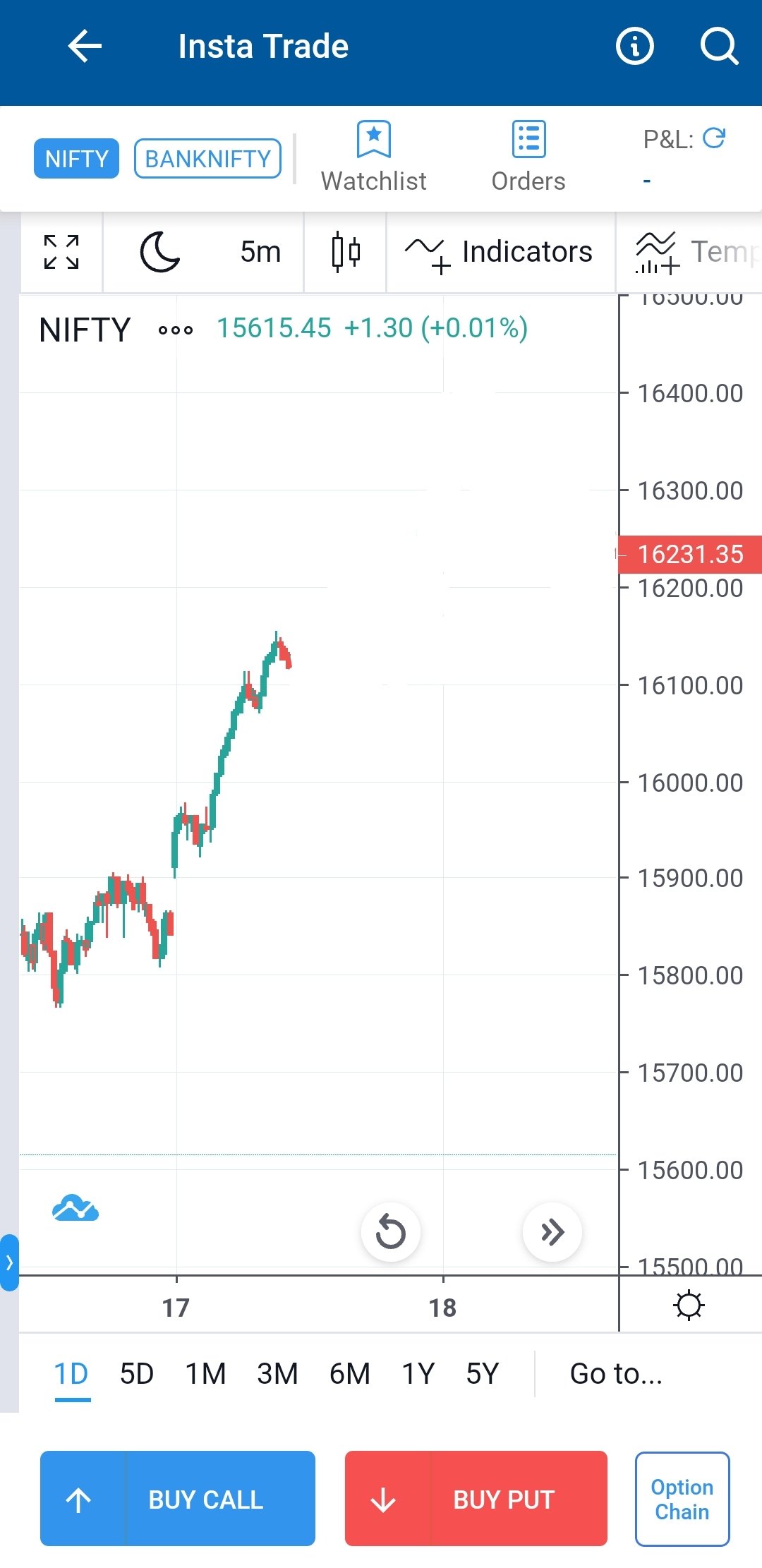

Can you help me with Identifying the trend on the Nifty Chart below?

Yes, you are right, it is in UPTREND.

Now, once you have identified the trend, there are chances the trend continues until there is some reversal pressure from the opposite side.

So let's see, what will happen to this trend.

Now, as you can see in the chart, the uptrend continued from the A point up to the B point.

But from B point it started to go down up to the C point.

As you can see, the uptrend continues up-to-the point B but from there it started getting reversal pressure.

So you just have to identify the trend and be part of it up to the time it starts getting reversal pressure.

How to do that? Let's understand this.

Again, let's analyse this below Nifty Chart

Can you guess the trend?

Down-trend?

So what's going to happen? This will continue to go down right? Let's see.

Oh, it has gone up. Maybe this time you are not lucky!

It got buying pressure, hence reversed.

Now again, the important question arises,

How do we know whether the trend is going to continue or will get reversed?

It can be simply identified with the use of the indicator named ‘Moving Average’.

Let's see how.

Here in the chart, we have plotted 21 Exponential Moving Averages also known as 21EMA.

So as long as the price is below the 21EMA from A to B point, it can be said that there is a downtrend. But at point B, 21EMA got broken and now the price started trading above 21EMA. Then it's a sign of trend reversal

i. e. From point B, the downtrend got changed into an Uptrend.

Moving Average eliminates noise from the price chart and helps you identify the trend better and the point at which the trend reverses.

If Nifty stays above the moving average line, then Nifty is trending upwards

If Nifty stays below the moving average line, then Nifty is trending downwards. And if the price crosses the line, then it can be said that the trend has reversed.

Moving Average Crossover

Let’s go one step further:

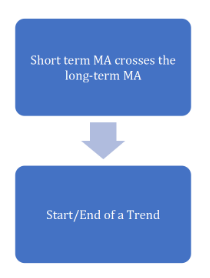

To make your entry & exit point more precise, you can plot two Moving averages.

One of the longer time-frame

Another shorter time-frame

As you can see in the chart, here we have plotted 60 SMA & 150 SMA (SMA~simple moving average).

How to analyse it?

It is simple, as long as short-term MA is above long-term MA, it can be said that the chart is in an uptrend.

If short-term MA goes below long-term MA, it can be said that the chart is in a downtrend.

The point at which Short-term MA & Long-term MA cross (crossovers), can be used for perfect ENTRY & EXIT.

In the above chart, you can see at Point A, that the short-term moving average crossed the long-term moving average from the downside, this indicates the start of the uptrend, and at this point, we can take a bullish view entry.

And, at Point B, where the short-term moving average crosses the long-term moving average from above, it indicates the end of the uptrend, so at this point, you can exit your bullish trade or can enter into a fresh Bearish trade.

So with the use of the moving average, you can predict the perfect entry & exit point.

This is one of the many setups, which can be used to predict market direction, to make perfect Entry & Exit.

You can start with this, and can keep improving.

You may also start observing some more setups, and some more precise, perfect entry points while trading continuously.

But this setup can act as a starting point that will make you comfortable in starting your options trading journey.

Try Insta Trade

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Next Article – How To fix A Stop Loss

Previous Article – Options Trading Basics - Part 2